International Money Laundering Threats

Money laundering has a significant international component, which can be visually represented as follows:

The Australian National Risk Assessment on Money Laundering (NRAML) provides a useful methodology for evaluating jurisdictional risks relating to ‘International threat’ – i.e., domestic money laundering with illicit funds sourced overseas. The NRAML methodology considers two key factors, the capability and intent of foreign nationals to move funds to Australia.

Capability

The greater the ease with which illicit funds can be moved from a foreign jurisdiction to Australia, the greater that jurisdiction’s capability. Factors that may facilitate the international movement of illicit funds include:

Proximity: Proximity can facilitate transport and decrease communication costs.

Shared characteristics: Similarities between countries make it simpler to conduct business.

Weak money laundering controls and financial regulation: Reduced visibility of money flows and a diminished ability to detect and disrupt illicit funds.

Size and presence of channels and networks: Channels such as trade, foreign investment, diasporas, organised crime links, and physical cross-border movements facilitate the movement of illicit funds.

Intent

More illicit activities within a foreign jurisdiction mean greater intent to move illicit funds offshore. Some factors that indicate illicit activities, and consequently increased intent, include high levels of criminality and corruption, low levels of resilience and a sizeable shadow economy.

Jurisdictional risks

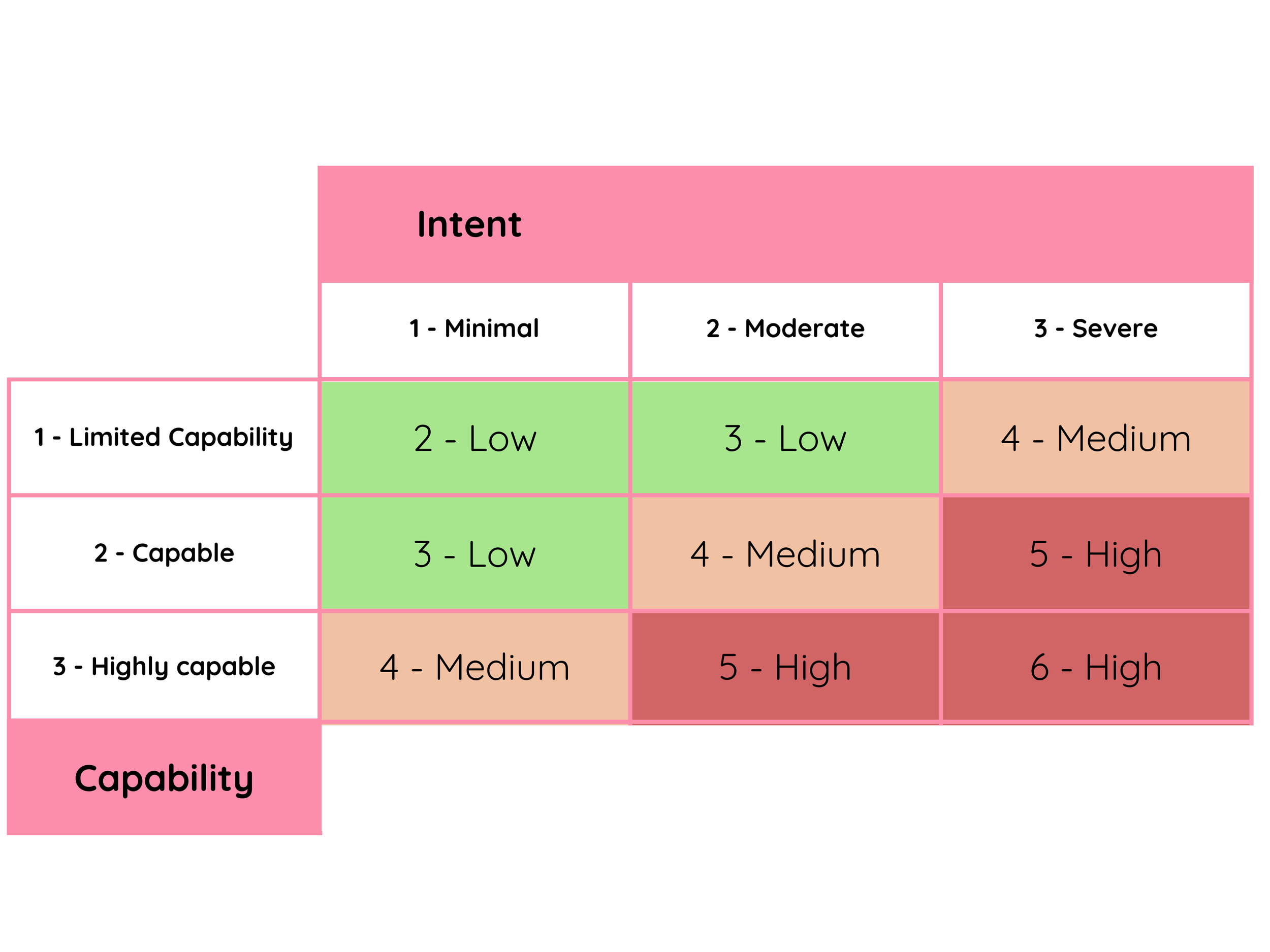

Generally, jurisdictions considered to pose a high threat would be those with high levels of both capability and intent. Therefore, a matrix combining capability and intent can be used to calculate jurisdictional risks.

However, the NRAML further revealed that a small handful of jurisdictions possess capabilities that far surpass those of others. These jurisdictions pose the greatest threat to Australia irrespective of their level of intent. These jurisdictions are not geographically close to Australia, being located in Asia, Europe, and the Americas, and they pose such threats because of their large volumes of trade with Australia, high levels of foreign investment, large diaspora communities or volumes of international travellers, or both.

Other reputable sources that you can use to assess a country’s jurisdictional risks are the Basel AML Index and Know Your Country.

What’s next

Get in touch if you need some help assessing your jurisdictional risks.