Guidance for Liquidators

Various new regulations took effect for the application of the Anti-Money Laundering and Countering Financing of Terrorism Act (AML/CFT Act) to both court-appointed and non-court-appointed liquidations. As liquidator conducting a liquidation, you likely carry out the following captured activities:

Managing client funds

Creating, operating, and managing a legal person or other legal arrangements

When providing such services, for the purpose of the AML/CFT Act, your clients are:

The company in liquidation

The limited partnership in liquidation

In other words, any other parties, for example directors or shareholders of the company in liquidation, partners of the limited partnership or creditors, are not your clients. However, remember that suspicious activity reporting obligations under the AML/CFT Act arise in relation to any person, not only your client, and not only related to ML/FT suspicions but to any type of criminal activity, present or historical.

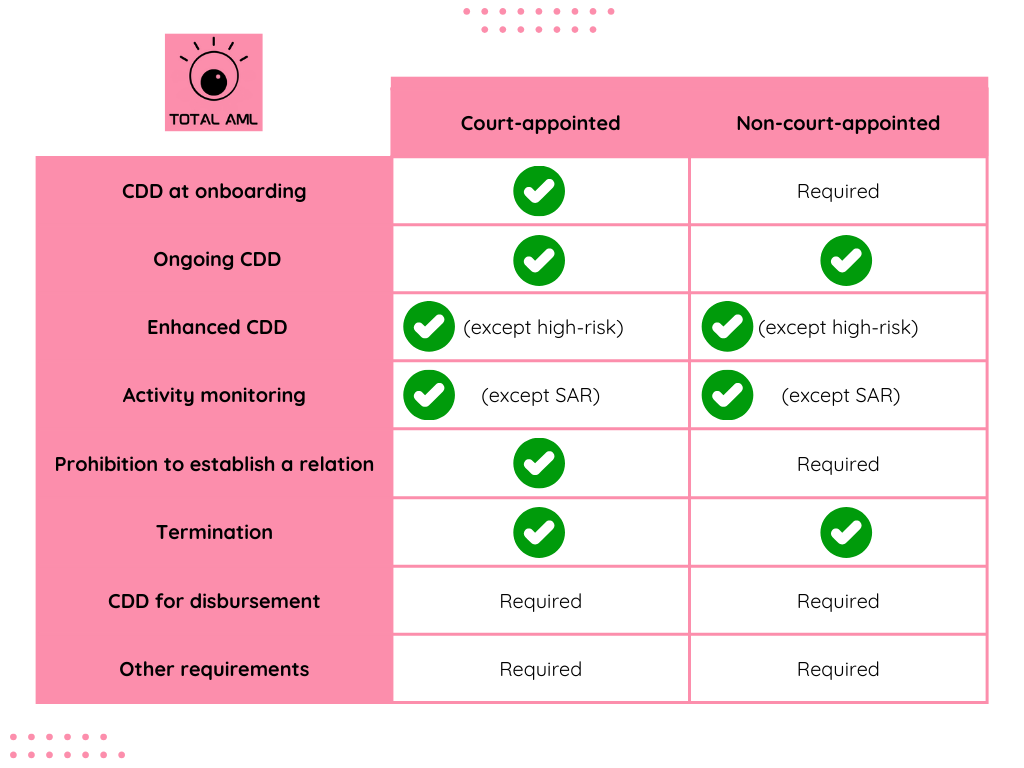

Court-appointed liquidators

As court-appointed liquidator, you do not have customer due diligence (CDD) obligations at the time of onboarding a new client, enhanced CDD obligations, and ongoing CDD and account monitoring obligations. With some exceptions:

You are required to conduct enhanced CDD when you consider the level of risk involved is such that enhanced CDD should be applied to a particular situation.

You still have an obligation to report suspicious activities.

Furthermore, you are exempt from not establishing or terminating a business relationship with a client if you are unable to conduct CDD. This means that the AML/CFT Act cannot prevent you from accepting appointment as a court-appointed liquidator, nor can it require you to terminate work on the liquidation once it has commenced.

Non-court-appointed liquidators

As non-court-appointed liquidator, you are required to conduct standard CDD on a client prior to accepting an appointment as liquidator. However, you are exempts from conducting enhanced CDD, ongoing CDD and account monitoring, with the caveats noted above.

Furthermore, you are required to not establish a business relationship with a client if you are unable to conduct CDD. But you are exempt from terminating a business relationship (after it has been established) if you are unable to conduct CDD.

Disbursements to beneficial owners – Both court-appointed and non-court appointed liquidators

When disbursing funds from the liquidation, and unless the person had already undergone CDD, you have a requirement to verify the identity of any beneficial owner(s) of the company or limited partnership that is a recipient of a disbursement. At the point of a disbursement of funds from a liquidation, a beneficial owner is any person that is due over 25% of the realisable assets from the company or limited partnership. This could include an underlying person that ultimately stands to benefit from these assets, and an individual that is a creditor, or an underlying individual with ownership of the creditor (e.g., director of a company if a company is a creditor).

Summary

The table below summarises these requirements, with the green ticks representing the exemptions.

What’s next

Check out the fill guidance here.

Get in touch if you want to talk about your requirements as a liquidator.